We did an analysis of the 'No-Fee' section of popular NYC apartment listing sites such as Streeteasy, Naked Apartments, Renthop, Zumper and soon realized that even though we used the 'No-Fee' filter, BROKERS have found ways to embed their BROKER FEES into rent prices, costing consumers millions.

Who Are The Real Customers?

How do listing sites make money? Easy. They charge for each listing post. Because of that, these listing sites are inherently biased towards having as many listings on their sites as possible because the more listings they have posted on their sites, the more money they make. So then who are their main customers? Real estate brokers! They are the listing sites' largest money generators because brokers need and use these aggregate listing sites to advertise their services. Due to these economic circumstances, listing sites as a byproduct, have the brokers' best interests at heart and not necessarily that of the consumers who go to the site looking for an apartment.

Are Listings On These Sites Accurate?

What is the accuracy of listings on these sites? Are the prices accurate? Are the fees accurate? To the listing sites, it would be ideal if all the information on the listing is as accurate as possible because they want the end consumer to have a good experience but in the end, it doesn't matter if a listing is good, bad, updated, outdated because it is numbers based and the more listings that are on the site, the more money listing sites make. Unfortunately it comes at the expense of the consumer. We have found countless examples where the end consumer is paying more than they need to and the examples are below. Nothing is illegal here. There are simply some flaws within the system and we are providing ways to get around it.

Our Findings

Without further ado, here is a sample of our findings based on Sherlock Holmes' sleuthing methods:

Example 1:

Remember that the property manager is the actual source of the listing.

Here is a screenshot of the actual listing found on the management company website:

If you contact the management company and rent directly from them, the deal is:

- Monthly Rent: $4995

- 12th Month Free which means a rebate of $4995 when you sign a 1 Year Lease

- No extra Broker Fee

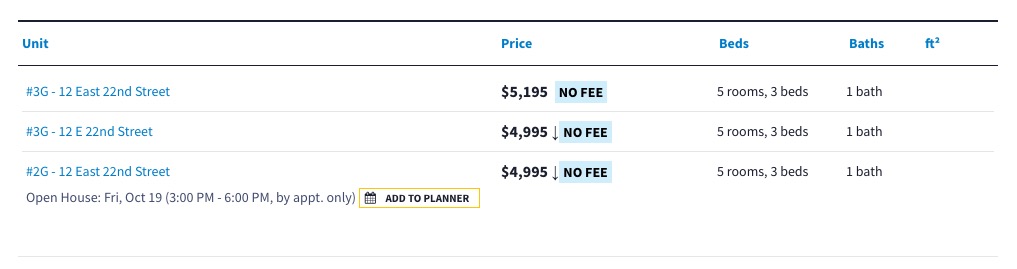

Here is a screenshot of the same listing found on Streeteasy advertised by 3 different brokers and they each are misleading.

We'll start with the top example and work downwards::

Here is A Screenshot Description Of The 1st Listing:

- Rent is $5,195 instead of $4,995 which is an increase of $200 per month or $2,400 for the year which the broker pockets

- In the description the broker claims that a 2-year lease MUST be signed in order for the listing to be broker fee-free. Otherwise a broker fee of $5,195 must be paid. In the NYC market, it is more commonplace to sign a 1-year lease.

- The broker collects the $4,995 from the management company that would have gone to you as the consumer on a 1-year lease because they pay out that incentive regardless of how a consumer signs the lease.

- Signing this on a 1-year deal swings the consumer from +$4,995 to -$7,595 which is a whopping $12,590 difference.

Here is A Screenshot Description Of The 2nd Listing:

- In the description the broker claims that a 2-year lease MUST be signed in order for the listing to be broker fee-free. Otherwise a broker fee of $4995 must be paid. In the NYC market, it is more commonplace to sign a 1-year lease.

- The broker collects the $4,995 from the management company that would have gone to you as the consumer on a 1-year lease because they pay out that incentive regardless of how a consumer signs the lease.

- Signing this on a 1-year deal swings the consumer from +$4,995 to -$4,995 which is a $9,990 difference.

- At least it is better than the 1st deal

Here Is A Screenshot Description Of The 3rd Listing:

- The broker listed the apartment at $4,995 but in the description he says it's $5,195.

- The broker listed the unit number of 2G but when we called in, the unit is actually 3G as well. Of course!

- Rent is $5,195 instead of $4,995 which is an increase of $200 per month or $2,400 for the year which the broker pockets

- The broker collects the $4,995 from the management company that would have gone to you as the consumer on a 1-year lease because they pay out that incentive regardless of how a consumer signs the lease.

- Signing this on a 1-year deal swings the consumer from +$4,995 to -$2400, which is a $7,395 difference.

- Sadly, this 3rd option is the best deal of the bunch.

Example 2:

In our next example, we see two other listing aggregator sites where two separate brokerages are advertising the same exact unit that can be found on the management company website. Further proving that listing aggregators have broker interests at heart and not the end consumer.

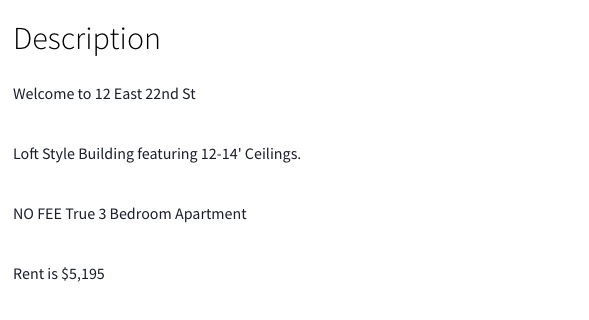

Here is a screenshot of the listing on the management company website:

- If you rent directly from the management company, you receive two months of free rent. This particular management company has a wide array of apartments ranging from $2,000 all the way to $15,000 but the listings ALL have a common theme and that is they provide consumers 2x more incentives than if a consumer walks in with a broker.

- The second line with the big 'OR" is an ad for brokers letting them know their 'OP' incentive which means Owner Paid. If a broker brings in a renter, instead of giving the renter 2 months free, they will get 1 month free and the broker will get 1 month.

- Signing this lease directly gets you $19,000 back versus $9,500 when going in with a broker.

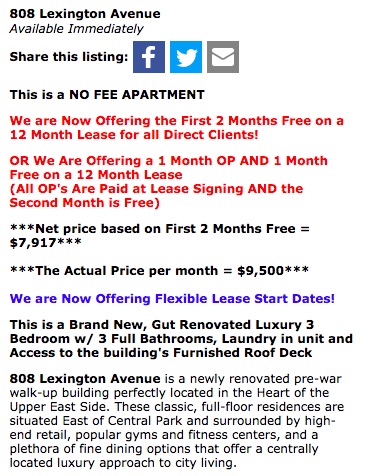

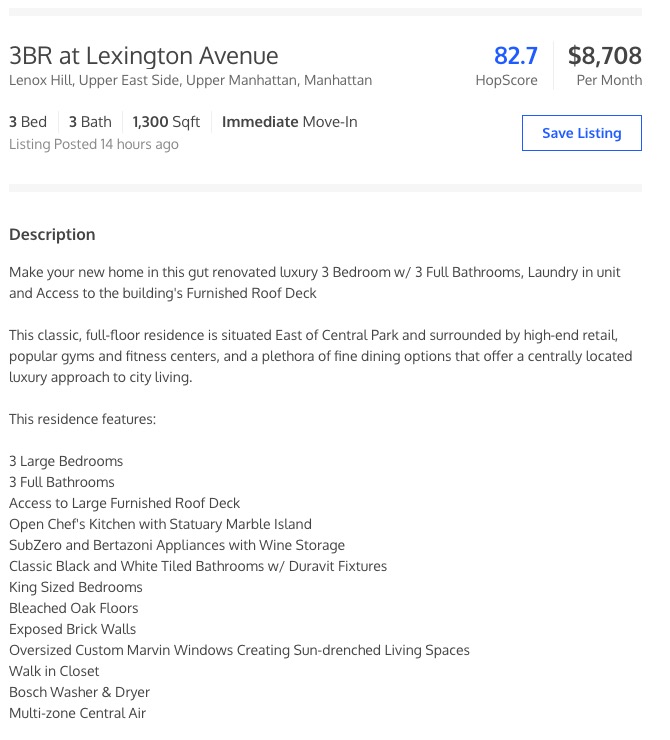

Here is a screenshot of the same apartment on Naked Apartments:

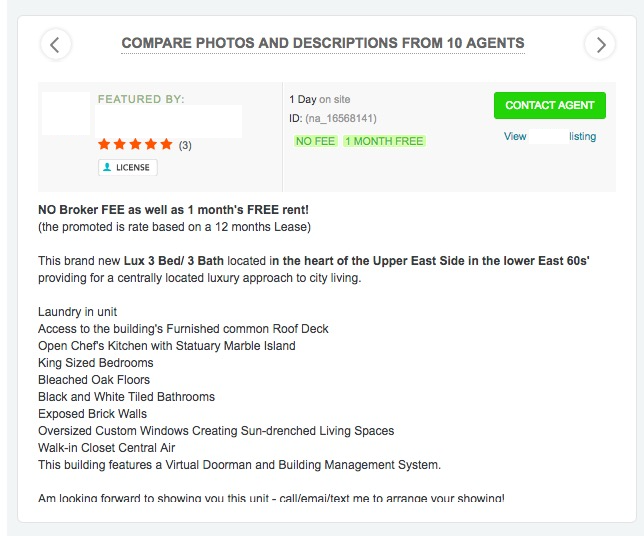

Here is a screenshot of the same apartment on Renthop:

- The two listings are two separate sites and two separate brokerages. In this example, they are consistent in taking 1 month of the 2-month incentive

- They both list the monthly rent as $8,708 even though you are going to cut a check of $9,500 every month.

- They are both advertised on the listing site as 'No-Fee' even though they shave off 1 months incentive of $9500. Does it count as 'No-Fee' when brokers get the money that would have otherwise gone to you as a consumer?

WTH Is Going On Here?

- It's equivalent to scalping tickets when you find yourself disappointed when you see the face value of the actual ticket that you bought at a massive premium

- Ignorance is bliss and sometimes the truth hurts

- Yes. This is how the rental market works in NYC

Why Is This Allowed?

From the management company perspective, occupancy rates are the number one priority. if you own/control a building, you want to make sure the apartments are occupied. Why should it matter to management companies how the end consumer finds the apartment? Management companies need help marketing their buildings and brokers come at no cost to management companies. From the management company perspective, brokers are a commission-based salesforce that provides free marketing and advertising that gets the management companies closer to their end goal of apartment occupancy. But this comes at the expense of the consumer in the form of fees. It all makes sense.

What Can Renters Do In Order To Save Themselves From This NYC Scam?

Go directly to the source, which is the management companies. There are a few hundred management companies that control thousands of rental buildings which equates to millions of apartments. If you rent directly from them, the extra costs go away and in many cases, they even provide incentives. How do you find the actual source? Fortunately at Transparentcity, we have databased all of the management companies that have good websites just like in the examples we provided. How else do you think we discovered this system flaw?

Are Brokers Evil?

NO! Brokers play important roles in the general NYC apartment ecosystem. At Transparentcity, we are only gathering data on the apartment buildings that are controlled by management companies. If you rent from any of those management companies, you as the consumer should NOT be paying any middleman fees because those deals are available to the general public. However, management company controlled buildings are less than half of the buildings in the city. If you want to rent in a condo or coop or a privately-owned residence, you will most likely have to pay a broker fee because in those instances, brokers are providing a service to private owners by renting their apartments out for them.

The Transparentcity End Goal

The majority of prospective renters are unsuspecting of the current NYC rental landscape. Who can blame them? It is so absurdly obscure. We have heard countless times from users/consumers who have told us they wound up paying a broker fee to rent in a no-fee building!!! Our end goal at Transparentcity is to shed some light on situations like this so that consumers are better informed. Users can also take solace in the fact that each building tagged in our database is 100% direct to management company building. We don't even have listings! We are leading you directly to the management company website where the listings are.

What we are suggesting is nothing new. There are countless blogs, articles out there all saying the same thing: find those management companies (websites, emails, phone numbers), those buildings they own, and contact them directly. All we are doing is aggregating all of that data together in an easy way for users to consume.

Happy apartment hunting!